Jagran Josh

HPBOSE Class 11 Accountancy Syllabus 2023-24: The Himachal Pradesh Board of School Education (HPBOSE) Class 11 Accountancy syllabus is an important resource for students for course planning and exam preparations. The syllabus includes unit-wise topics for the 2023-24 examination. It also mentions unit-wise weightage distribution and question paper blueprint. Thus, by knowing the marking scheme and number and format of questions, students can prepare for their HP Board Class 11 Accountancy Exam 2023-24 in the right way. In this article, we have provided the detailed syllabus which you may check and download the complete syllabus in PDF.

HP Board Class 11 Accountancy Syllabus 2023-24

Course Structure

|

Accountancy (Theory) |

80 Marks |

|

Internal Assessment |

20 Marks |

|

Total |

100 Marks |

Course Content

PART A: FINANCIAL ACCOUNTING I

1.Introduction to Accounting

2.Theory Base of Accounting

3.Recording of Business Transactions

4.Trial Balance and Rectification of Errors

5.Depreciation, Provision and Reserves

6.Accounting for Bills of Exchange Transactions

PART B: FINANCIAL ACCOUNTING II

7.Financial Statements

8.Computers in Accounting

9.Accounting and Database System

PART-A: FINANCIAL ACCOUNTING

Unit 1: Introduction to Accounting

(a) Accounting – Meaning Objectives. Accounting as source of information internal and external users of Accounting Information and their needs

(b) Qualitative Characteristics of Accounting Information: Reliability Relevance.

Understandability and Comparability

(c) Basic Accounting Terms : Asset, Liability, Capital. Expense, Income. Expenditure Revenue Debtors, Creditors, goods, cost, Gain, Stock, Purchase Sales Loss, Profit, Voucher. Discount, Transaction, Drawings

Unit 2: Theory Base of Accounting

Accounting Principles : Meaning and nature

Accounting Concepts : Entity. Money Measurement, Going Concern

Accounting Period Cost Concept, Dual Aspect Revenue Recognition (Realisation)

Matching, Accrual, Full Disclosure Consistency Conservatism, Materiality

Accounting Standards : Concept

Process of accounting from recording of business transactions to preparation of trial balance

Bases of Accounting- Cash Basis, Accrual Basis

Unit 3: Recording of Business Transactions

Voucher and Transactions Origin of Transactions-Source Documents and Vouchers, preparation of Accounting Vouchers Accounting Equation Approach- Meaning and Analysis of transactions using Accounting Equation Rules of Debit and Credit

Recording of Transactions Books of original entry-Journal, Special Purpose Books i) Cash Book- Simple, Cashbook with Bank Column and Petty Cashbook (1) Purchases Book, Sales Book, Purchase Returns Book, Sales Returns Book Ledger-meaning, utility, format, posting from Journal and Subsidiary books, Balancing of Accounts

Bank Reconciliation Statement Meaning. Need and Preparation, Corrected Cash Balance

Unit 4: Trial Balance and Rectification of Errors

Trial Balance Meaning, Objectives and Preparation

Errors: Types of Errors, errors affecting Trial Balance and Errors not affecting Trial Balance

Detection and Rectification of Errors (One Sided and Two Sided), use of Suspense Account

Unit 5: Depreciation, Provisions and Reserves

Depreciation : Meaning and Need for charging depreciation, Factors affecting depreciation Methods of depreciation – Straight Line method Written Down Value Method (excluding change in method). Method of recording depreciation-charging to asset account creating provision for depreciation/accumulated depreciation account.

Treatment of disposal of asset

Provisions and Reserves : Meaning and importance, difference between Provisions and Reserves types of Reserves Revenue Reserve, Capital Reserve, General Reserve, Specific Reserve and Secret Reserves

Unit 6: Accounting for Bills of Exchange Transactions

Bills of Exchange and Promissory Note : Definition. Features, Parties Specimen Distinction.

Important Terms : Term of Bill, Concept of Accommodation Bill Days of Grace, Date of Maturity. Bill at Sight Negotiation, Endorsement Discounting of bill. Dishonour.

Retirement and Renewal of a bill.

Accounting Treatment of bill transactions

PART B: FINANCIAL ACCOUNTING-II

Unit 7: Financial Statements

Financial Statements : Meaning and Users

Distinction between capital Expenditure and Revenue Expenditure. Trading and Profit and Loss Account Gross Profit, Operating Profit. Net Profit.

Balance Sheet : need, grouping and marshalling of Assets and Liabilities, Vertical Presentation of Financial Statement

Adjustments in preparation of financial statements with respect to closing stock, outstanding expenses, prepaid expenses accrued Income

Income received In advance, depreciation and bad debts, provision for doubtful debts, provision for discount on debtors, manager’s commission

Preparation of Trading and Profit & Loss Account and Balance Sheet of sole proprietorship.

Unit 8: Computers in Accounting

Introduction to Computer and Accounting Information System (AIS) Applications of computers in accounting

Automation of accounting process, designing accounting reports, MIS reporting, data exchange with other information systems

Comparison of accounting processes in manual and computerized accounting, highlighting advantages and limitations of automation

Sourcing of accounting system: readymade and customized and tailor-made accounting system. Advantages and disadvantages of each option

Unit 9: Accounts from Database System

Accounting and Database Management System

Concept of entity and relationship : entities and relationships in an Accounting System designing and creating simple tables, forms, queries and reports in the context of Accounting System.

Download link of the syllabus PDF is mentioned below:

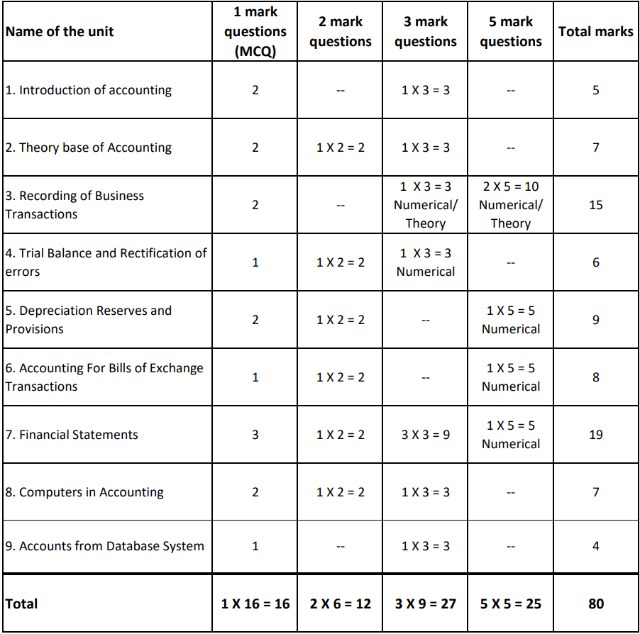

HP Board Class 11 Accountancy Exam Pattern and Marking Scheme 2024

Unit-Wise Distribution of Marks

|

Unit No. |

Particulars |

Marks assigned |

|

1 |

Introduction of accounting · Accounting : An Introduction · Basic Accounting terms |

5 |

|

2 |

Theory base of Accounting · Accounting Concepts and Principles · Accounting Standards · Basis of Accounting |

7 |

|

3 |

Recording of Business Transactions · Accounting Equation · Elements of Double Entry System · Books of Original Entry : Journal, Ledger, Subsidiary books, Cash · Book Bank Reconciliation Statement |

15 |

|

4 |

Trial Balance and Rectification of errors · Trial Balance · Errors and their rectification |

6 |

|

5 |

Depreciation Reserves and Provisions · Depreciation · Reserves and Provisions |

9 |

|

6 |

Accounting For Bills of Exchange Transactions · Bills of Exchange |

8 |

|

7 |

Financial Statements · Presentation of Final Accounts · Financial Statements · Financial Statements with Adjustments |

19 |

|

8 |

Computers in Accounting · Computers in Accounting · Accounting Information System |

7 |

|

9 |

Accounts from Database System · Accounting from Database System |

4 |

|

Total |

80 |

|

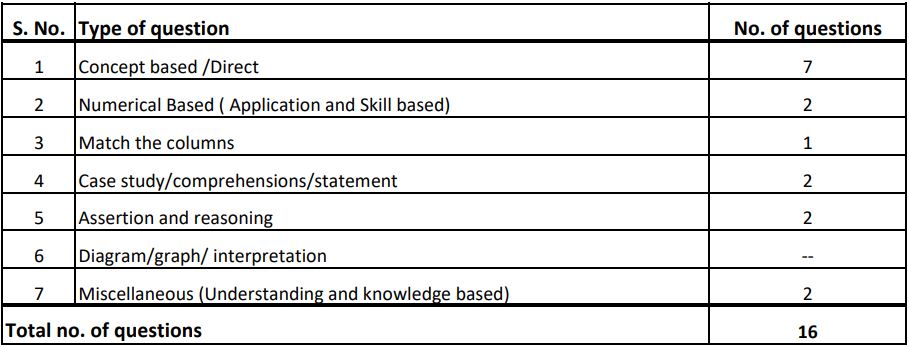

Design of HPBOSE Class 11 Accountancy Question Paper 2024

Accountancy (Theory) paper in HP Board Class 11 will be of 80 Marks for 3 hours.

Blue Print of Question Paper

Blue Print of MCQs

Each MCQ carries one mark only

No internal choice be given in the MCQ section

#Board #Class #Accountancy #Syllabus #Exam #Pattern #Marking #Scheme #Question #Paper #Design