Jagran Josh

CBSE Class 12 Retirement or Death of a Partner Notes: Here, students can find revision notes of CBSE Class 12 Accountancy Chapter 3 Reconstitution of a Partnership Firm- Retirement or Death of a Partner along with a PDF download link for the same.

Retirement or Death of a Partner Class 12 Notes: In this article, students can find revision notes for CBSE Class 12 Accountancy Chapter 4, Reconstitution of a Firm- Retirement/Death of a Partner. Students can also find attached a PDF download link to save the notes for future reference. The entire set of revision notes for Class 12 Retirement or Death of a Partner is prepared as per the updated and revised CBSE Syllabus 2024.

Revision Notes are a compilation of all the important materials or information present in the chapter. All of the essential points are picked up from the chapter and arranged at a single location by us. These will prove to be handy and might assist you in quick revision of the chapters.

Related:

CBSE Class 12 Accountancy Syllabus 2023-2024

CBSE Class 12 Accountancy MCQs

NCERT Solutions for Class 12 Accountancy

CBSE Class 12 Accountancy Chapter 2 Mind Maps

CBSE Class 12 Accountancy Chapter 1 Revision Notes

CBSE Class 12 Accountancy Chapter 2 Revision Notes

Revision Notes for CBSE Class 12 Accountancy Chapter 3 Reconstitution of a Partnership Firm –Retirement/Death of a Partner

Accounting Aspects Involved in Retirement or Death of a Partner

When a partner retires or dies, the following aspects of accounting are relooked at and changed:

- Ascertainment of new profit sharing ratio and gaining ratio

- Treatment of goodwill

- Revaluation of assets and liabilities

- Adjustment in respect of unrecorded assets and liabilities

- Distribution of accumulated profits and losses

- Ascertainment of share of profit or loss up to the date of retirement/death

- Adjustment of capital, if required

- Settlement of the amounts due to retired/deceased partner

New Profit Sharing Ratio

The ratio in which the remaining partners will share future profits after the retirement or death of any partner. Post-retirement or death of a partner, the profit share of the existing partner will include his profit share along with the share gained from the profit of the deceased or retired partner.

New Profit Sharing Ratio of the Continuing Partner = Old Share + Acquired share from the Outgoing Partner

What is the Gaining Ratio?

The ratio in which the continuing partners have acquired the share from the retiring/deceased partner is called the gaining ratio. Usually, the profit-sharing ratio of the deceased partner is divided similarly to the old profit-sharing ratio of the partners. In such a scenario, there is no need to calculate the gaining ratio.

Mathematically,

Gaining Ratio = New Share – Old Share

Hidden Goodwill

The amount of goodwill given to the retired/deceased partner by paying him an excess of what his capital account holds is called hidden goodwill. It is given by making necessary adjustments in respect of accumulated profits and losses and revaluation of assets and liabilities.

Treatment of Goodwill

Since goodwill is built by the joint effort of all the partners in a firm, the goodwill is compensated for the deceased/retiring partner in their old profit-sharing ratio.

- When goodwill does not appear in the books

When goodwill does not appear in the books of the firm, credit is given to the retiring partner for the share in goodwill by debiting the goodwill account to the gaining partners’ capital accounts (individually) in their gaining ratio.

Adjustment for Revaluation of Assets and Liabilities

Sometimes it may happen that the assets of the retiring/deceased partner might not be written at their current values or the liabilities might not be written at the obligations fulfilled by the company or some assets/liabilities might have not made it to the journal. In all these cases, a revaluation account is prepared to keep track of the missing assets/liabilities or calculate the revalued assets/liabilities, the same of which is transferred to the capital account of all the partners. Various journal entries passed in different situations are as follows:

- For increase in the value of assets

- For decrease in the value of assets

- For increase in the amount of liabilities

- For decrease in the amount of liabilities

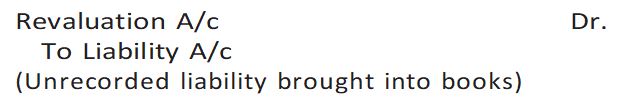

- For an unrecorded liability

- For distribution of profit or loss on revaluation

To download the complete Revision Notes for CBSE Class 12 Reconstitution of a Partnership Firm – Retirement or Death of a Partner, click on the link below

Also Check:

CBSE Class 12 Commerce Study Materials

#Reconstitution #Partnership #Firm #Retirement #Death #Partner #Class #Notes #CBSE #12th #Accountancy #Chapter #Download #PDF